Do Credit Card Companies Know What You Buy

What Is Credit Card Processing and How It Works

In this guide, we walk you through everything you demand to know near credit card processing—and how to select the best choice for your business.

Table of contents

- Four Frequently Asked Questions About Credit Carte Processing

- What is credit card processing?

- The parties involved in credit card processing

- Merchant credit menu processing

- How does credit card processing work?

- Credit card processing fees

- Accepting credit cards

Intro

Intro to Credit Card Processing

You don't need to know the ins and outs of credit bill of fare processing to own and operate a business concern. Just it definitely helps to get the lay of the land. In this guide, we walk you through everything you need to know nearly credit carte processing—and how to select the best option for your business.

FAQ

Four Frequently Asked Questions About Credit Card Processing

1. What is a credit card processing company?

A credit carte processing company (like Foursquare) handles credit and debit menu transactions for businesses.

2. How does credit card processing piece of work?

Credit menu processing works through several parties. These include issuing banks, acquiring banks, and the merchant services provider.

iii. How much are credit carte processing fees?

Foursquare's pricing is simple—2.half dozen% + 10¢ for magstripe card transactions, chip card transactions, and contactless (NFC) payments. The fee for manually entered transactions is iii.5% + 15¢.

iv. How can I have credit card payments?

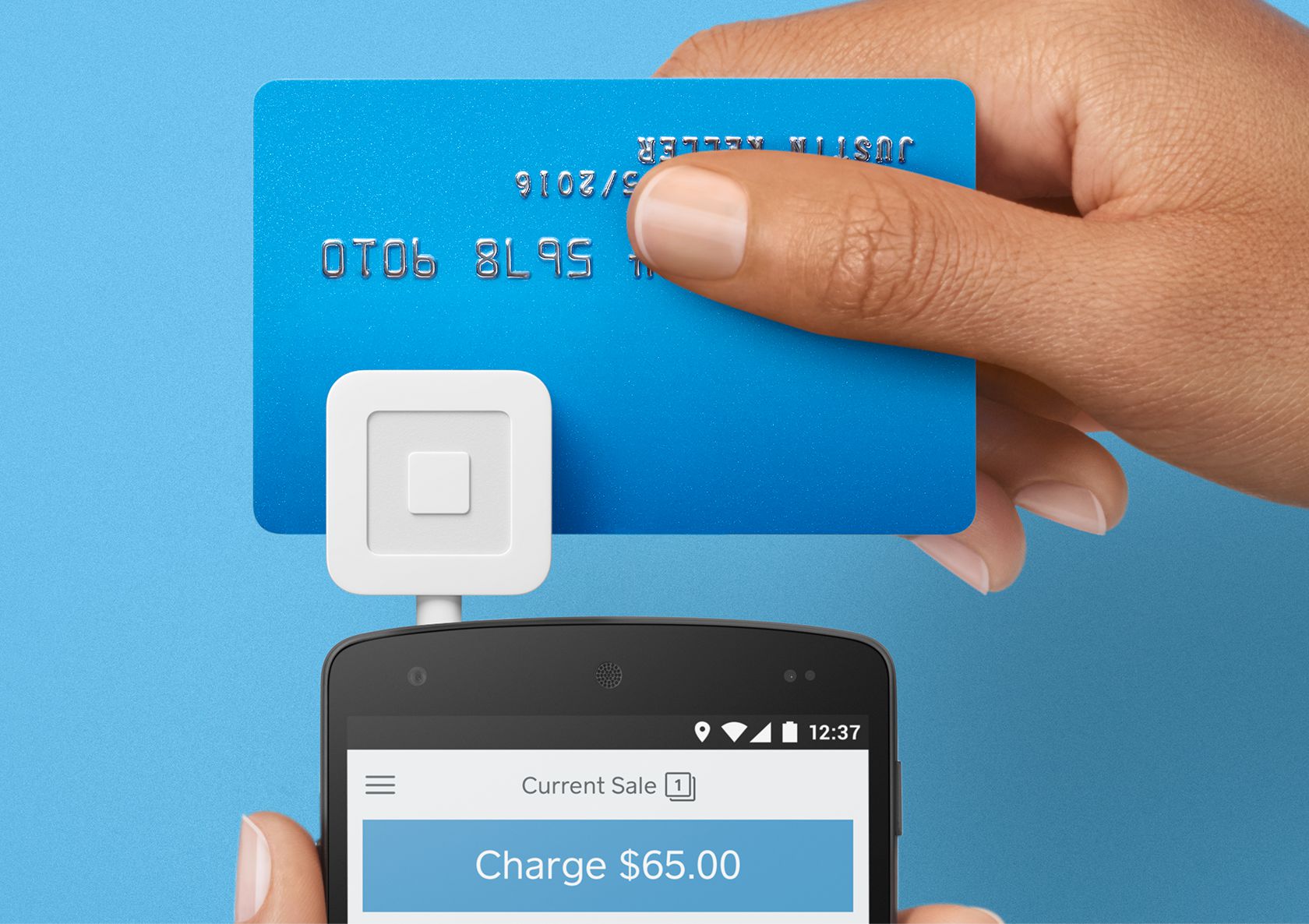

To accept credit card payments, you need a credit card reader. Square'south latest and greatest reader is just $49 and accepts EMV bit cards and NFC payments.

Become your free Square Reader for magstripe.

Fast setup, clear pricing, and no long-term commitments—kickoff selling today with a Square Reader.

Deep Dive

What is credit card processing?

Taking a credit card payment may seem simple enough. A client hands over a carte, you process it, and with Square, the coin usually lands in your account inside one to two days. (With Foursquare Instant Deposit, information technology lands instantly. The price is 1% per eolith). But under the hood, in that location's a lot more than going on. From the fourth dimension you swipe or dip the card until the time the coin is deposited into your bank account, there are a number of different parties involved. And each of them handles a crucial step in the chain of events. Having a general knowledge of how credit card processing works helps you understand where you might incur fees—and informs your decision virtually what credit card processing system makes the most sense for your business.

The parties involved in credit card processing

Let'south say you go into a identify called Cup of Joe Java and pay for a latte. Here are the official names of the players involved in the transaction:

- The cardholder: this is the person with the credit card (aka yous)

- The credit carte: that rectangular slice of plastic with your payment credentials on it (e.thousand., Capital One Quicksilver Rewards card)

- The merchant: the business concern accepting your credit carte du jour equally payment for goods or services (Loving cup of Joe Coffee)

- The bespeak-of-sale organization: the interface used by the merchant to accept the credit carte payment (east.g., a Square Reader or Stand up)

Now allow'due south zoom in for a 2d. There are a few additional parties represented on the credit card and in what's happening during the transaction itself. They are:

- The issuing banking company

- The acquiring bank

- The merchant services provider

In that location are a number of unlike parties involved in processing credit carte du jour payments.

Let's wait at each of these:

What is an issuing bank?

The issuing depository financial institution is the fiscal institution that provides yous with your credit card and accompanying line of credit. It'south basically your credit card visitor. Issuing banks human action as middlemen between you and the credit card networks by issuing contracts with cardholders for the terms of the repayment of transactions. For example, your issuing banking company could be Capital One.

What is an acquiring bank?

The acquiring banking concern (also known as a merchant depository financial institution or acquirer) is the bank that sends the transactions to the network, which then passes it on to the issuing banking company.

What is a merchant services provider?

A merchant services provider is an entity that allows businesses to take payments past credit carte du jour, debit card, and as well NFC mobile wallet (similar Apple Pay, Samsung Pay, and Android Pay). A merchant services account is established with an organization that has relationships with the issuing and acquiring banks. Your merchant services provider allows the processing of electronic payments when your customers want to pay for things.

What is a payments gateway?

Say Loving cup of Joe Coffee had an online store to sell things like T-shirts and mugs. Something called a payments gateway would be involved in processing those online credit bill of fare transactions. A payments gateway facilitates the transfer of information betwixt a payment portal (like a business'southward website) and the acquiring bank. It encrypts sensitive information similar carte numbers to make certain everything is secure throughout the process.

Payments are just the start

Foursquare helps have intendance of the day-to-day stuff, too. From signal of auction to payroll, we accept all kinds of services to help y'all save time and run more smoothly.

Merchant credit card processing

How practice you lot become a merchant services account?

Conventionally, if you wanted to outset processing credit cards, you'd employ for a merchant services business relationship at a depository financial institution, which tin can be a cumbersome process. Subsequently you were approved, you would so associate your point-of-sale organisation with your merchant business relationship and could outset accepting credit cards.

But with Square, things work a little differently. Square itself has a merchant services account with acquiring banks. We essentially human action as i giant merchant services business relationship for all businesses that use Square.

What is a high-run a risk merchant services business relationship?

In the credit menu processing world, some types of businesses may be considered "high risk." High-risk merchant services accounts can have steeper fees and stricter terms. Institutions may besides deny loftier-risk merchants an business relationship.

There'due south no hard dominion, but certain types of businesses tend to be flagged as high-take a chance merchants more than others. These tin can include businesses that sell goods or services that border on illegal, buyers' or membership clubs, credit counseling or repair services, and businesses that engage in questionable marketing tactics. Read Square's user agreement and terms of service for more information.

How does credit card processing piece of work?

Now that nosotros've gone through all the parties involved in credit carte du jour processing, we'll walk through how everything really works. Let's go back to Cup of Joe Java. You hand the barista your card and she processes information technology. What happens next?

Here is how a credit carte is processed with Foursquare:

Authority

When a merchant swipes or dips (in the example of EMV) a client's carte du jour, the request is submitted to Foursquare. Nosotros and so ship the transaction to the acquiring bank, which then sends information technology to the issuing banking company for potency. The issuing bank is checking for sufficient funds. It is also running the transaction through fraud models to decide if the transaction is safe (to protect the cardholder and the issuing bank).

Batching

This is the settlement stage, i.eastward., how the coin from a transaction is sent to the acquirer to brainstorm the process of depositing it into the merchant'south business relationship. It'due south called batching considering payments are sent in a big grouping.

Funding (aka settlement)

The funding (or settlement) step is when businesses get the money from a credit card sale deposited into their account. Square'due south eolith schedule is usually inside one to 2 business days. But if you set up Square Instant Deposit, you get your money instantly—24/7. The toll is just i% per deposit.

Credit card processing fees

Many companies take a ton of subconscious fees when it comes to credit card processing. These can include transactional fees (like interchange reimbursement fees and assessments), flat fees (similar PCI fees, annual fees, early termination fees, and monthly minimum fees), and incidental fees (like chargebacks or verification services). Square, on the other manus, has none of these.

Choose your credit card processing solution advisedly, some companies can have hidden fees.

Foursquare'due south pricing is simple—there are no hidden fees. It's simply 2.half dozen% + 10¢ for magstripe carte du jour transactions, flake card transactions, and contactless (NFC) payments. The fee for manually entered transactions is 3.five% + xv¢. These fees use to all business types, including nonprofit organizations.

Accepting credit cards

What is a credit card machine?

You need to go a new piece of applied science to process credit cards. A credit card machine, aka a bespeak of sale (POS) is a device that interfaces with payment cards to make electronic fund transfers. Newer betoken-of-sale systems (like the Square contactless and chip reader) also accept mobile NFC payments like Apple Pay, Android Pay, and Samsung Pay.

Credit card car prices

Some credit card machines tin costs hundreds of dollars. Foursquare's latest credit card reader, on the other hand, costs just $49. The Square contactless and chip reader accepts EMV fleck cards and NFC payments.

Mobile credit card machines

A lot of point-of-sale systems are big and clunky. Square's POS products are sleek and completely mobile. They're designed to look neat on your countertop when y'all're selling at your brick-and-mortar shop, and fit in your pocket if you're selling on the get.

How to set up credit bill of fare processing for your small business

If you're new to all this, or are simply starting your beginning concern, getting ready to process credit cards may seem daunting. Luckily, that doesn't have to be the case. Nowadays, with tools similar Square, it's very easy to get upward and running with accepting credit cards at your minor business organization. In fact, all you need is your mobile device. Foursquare works directly with the device you already have to accept credit menu payments and, with our new reader, NFC payments like Apple Pay.

Hither's a step-by-step guide for how to first accepting credit card payments:

- Guild the Square contactless and fleck reader and tell us where to postal service information technology.

- Create your complimentary Square account.

- Download the free Square app and link your banking company account for fast deposits.

- Connect the reader to your smartphone or tablet and start taking payments.

How to procedure credit cards

Credit cards are processed differently based on the type of card. Magstripe cards are swiped horizontally through the credit card reader. EMV bit cards are dipped vertically into the payments reader for the entire transaction. You can spot an EMV carte by the tiny fleck in the corner of the menu.

EMV scrap cards are a much more secure form of payment than magstripe cards.

What blazon of credit cards should you accept?

You lot should set your business concern upwardly to take EMV chip cards as soon equally possible. EMV chip cards are far more secure than magstripe cards (which have been around for decades). Magstripe cards are relatively easy to counterfeit and have skyrocketed fraud rates in the U.s.a.. EMV chip cards take enhanced security features that protect against cloning and counterfeiting. To assist curb fraud, U.S. banks are rolling out EMV bit cards to consumers en masse. Soon, most people will have them.

Merely there'due south some other reason you should have EMV flake cards at your business—the liability shift. Under the liability shift (which went into effect in October 2015), businesses that aren't prepare to accept EMV chip cards could now be on the hook for certain types of fraudulent transactions (whereas previously the banks ate this price). And then to protect your business from unwanted charges, it'due south smart to get a signal-of-sale system that is EMV compliant.

What other types of payments should you accept?

In addition to EMV fleck cards, it's a expert idea to as well accept NFC mobile payments like Apple Pay, Android Pay, and Samsung Pay. These new payment methods are just as secure as EMV but are a far better customer experience. Whereas EMV chip cards have several seconds to process (which is really slower than magstripe cards), NFC mobile payments are instantaneous. They're also picking up steam. Inquiry firm BI Intelligence projects that merchants will quickly brainstorm to unlock the potential of mobile payments this year, forecasting that U.Due south. in-store mobile payments will grow from $120 billion in 2016 to $808 billion past 2019.

Accept credit cards anywhere.

Fast setup, clear pricing, and no long-term commitments—start selling today with a free Square Reader for magstripe.

Source: https://squareup.com/us/en/townsquare/credit-card-processing

0 Response to "Do Credit Card Companies Know What You Buy"

Post a Comment